As global mergers and acquisitions rise to an all-time high and firms scramble to deploy capital through the pursuit of target companies, the importance of incorporating Environmental, Social, and Governance (ESG) considerations as part of a deal has moved to center stage.

In a webinar hosted by Antea Group and moderated by Ben Hansen, we had the opportunity to hear from Antea Group experts in mergers & acquisitions, sustainability, and private equity. Owen McKenna, Nina Smoker, and Kevin Moyer, walked us through a playbook on how to use ESG to attract and manage capital, reduce risk, increase cost savings, boost your reputation, and drive long-term value.

If you missed the webinar, you can still watch it on-demand!

Watch On-DemandESG Investment Integration

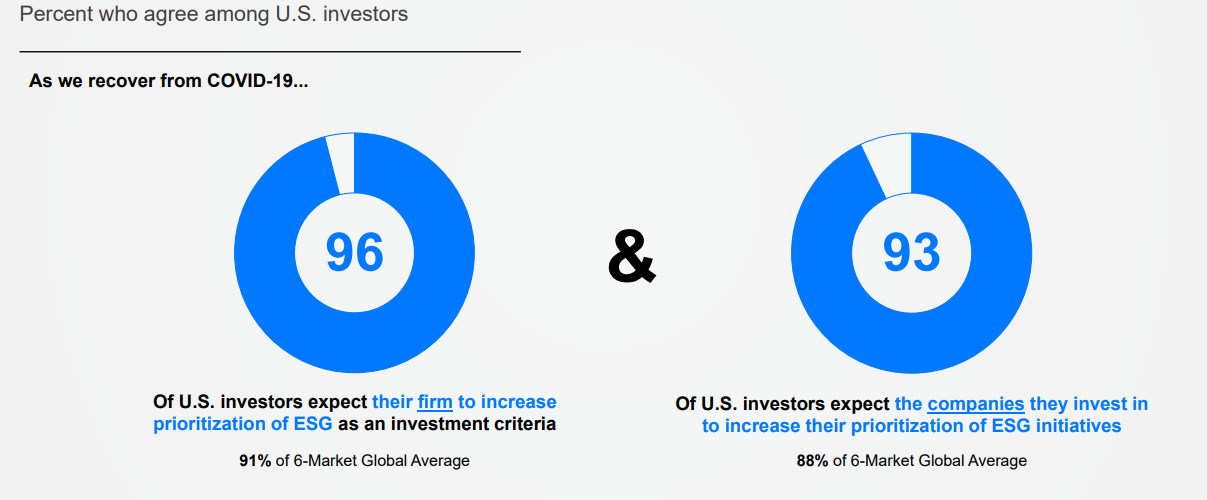

ESG has become a hot topic as of late in the financial community. In fact, according to the 2020 Edelman Trust Barometer Special Report: Institutional Investors, 96% of US investors expect their firm to increase the prioritization of ESG as an investment criteria.

Image source: 2020 Edelman Trust Barometer Special Report: Institutional Investors

Luckily, there are many benefits to ESG integration. Not only will it help meet the demands of both internal and external stakeholders, but it will also give your business an opportunity to get ahead of the curve. This is a great strategy to bolster the reputation of your company and carve out a competitive differentiator for your business and begin to build value. It can be a great way to build relationships which will aid in fundraising when needed. And finally, ESG integration can help identify and mitigate ESG-related risk at the onset of acquisition, which could save valuable time, money, and resources from the start.

When considering ESG integration as part of your firm’s investment thesis, there are three key stages to consider in a potential acquisition:

- Pre-investment: during this stage, begin to define how you will determine which ESG topics are financially material to the business, how you plan to screen for risks and opportunities against those topics, and how you can effectively integrate the findings into your investment considerations.

- Active Ownership: at this stage, consider your approach to building value into the company around ESG post-acquisition. What is the timetable for integrating and realizing a new ESG strategy and how will you track and communicate the progress along the way?

- Exit Considerations: in this final stage, define your approach to effectively articulating the value you’ve created through improved ESG performance.

Target Due Diligence

When it comes to due diligence, there are many challenges around evaluating ESG - from time limitations, to communication, to determining the level of scrutiny necessary to the deal, not to mention the accuracy and consistency of utilizing third-party ESG data providers. Each data provider takes a unique approach using a vast array of sources and proprietary ESG frameworks. This can result in little correlation between ESG ratings across vendors. That being said, third-party ESG data should not be relied on as the sole approach.

Instead, focus on what is material, as there is no reliable evidence that companies scoring higher on aggregated ESG metrics will deliver better financial performance. But there is evidence that outperformance on select, financially material ESG issues can, over time, have a substantial economic impact. Once materiality is determined, it becomes easier to establish a link between ESG impact and financial performance, providing a more meaningful analysis. To help identify material topics, consider conducting a materiality assessment.

Supporting ESG Frameworks

To help identify financially material ESG topics, the Sustainability Accounting Standards Board (SASB) has created standards to link ESG impact and corporate financial performance. These standards help identify the specific metrics that are material to a particular industry and, in turn, provide more valuable, reliable insights on specific and relevant ESG issues.

Once you have identified a set of financially material ESG issues to evaluate using SASB standards, it is time to gather relevant ESG data on them. This is often done through a public records search of target disclosures, target interviews, or by using specific ESG data vendors. First, evaluate corporate performance on a binary basis (i.e., does the company have greenhouse gas emissions data), then, where applicable, evaluate by numerical ranking. To help with accurate numerical banking, use an industry benchmarking service so the target’s performance can be evaluated against its peers. You may need to normalize it against a metric such as revenue or total employees to provide industry comparability.

Strategy Development

At this point, it’s time to begin building your ESG program. To help you get started, we’ve created a “playbook” to walk you through our 7 steps to developing an effective ESG strategy so you can reduce risk, increase cost savings, boost your reputation, and drive long-term value.

- Conduct a Materiality Assessment: this will help you focus in on the key ESG issues and opportunities that are most likely to affect your company’s business performance as well as your stakeholders.

- Establish a Baseline: once you know which ESG topics to prioritize, it’s important to assess the current status of existing programs, policies, metrics, and engagements in the company.

- Set Goals: start setting your sights on how you can focus efforts moving forward. For each priority topic, decide if you want to maintain or improve.

- Conduct a Gap Analysis: identify what may be missing between your current state and your objectives or goals so you can strategize and plan accordingly for the future.

- Prepare a Roadmap: this should clearly outline where your organization’s vision and purpose meet your ESG priorities and establish accountability for key actions.

- Track KPIs: identify clear and measurable outcomes that define what success looks like for you and track them with KPIs.

- Report Progress: the most important component of reporting is ensuring the data you want to convey is easily accessible by your stakeholders. ESG disclosure should include:

- Communicating ESG strategy while demonstrating alignment to business objectives.

- Highlighting ESG policies and programs in place.

- Sharing company-specific ESG goals and metrics.

- Evaluating your progress and engagements on your material ESG issues.

For a more detailed, in-depth look at each of the 7 steps and a downloadable infographic, see our blog 7 Steps to Develop and Implement an ESG Strategy

If you haven’t already, now is the time to take action and develop a strategy for ESG integration. By identifying financially-material ESG issues and working through our 7-step playbook, you can build an ESG program that creates enterprise value.

For help getting started, reach out to our team of experts today.

Want more news and insights like this?

Sign up for our monthly e-newsletter, The New Leaf. Our goal is to keep you updated, educated, and even a bit entertained as it relates to all things EHS and sustainability.

Get e-NewsletterHave any questions?

Contact us to discuss your environment, health, safety, and sustainability needs today.